Impact of Fed Decision on Interest Rates: What Does it Mean for the Fed to be Allowing Higher Inflation?

On August 27, 2020, Jerome Powell, the Chairman of the Federal Reserve, made a historic speech that changed Federal Reserve policy. The Fed has a dual mandate – they are tasked with maximizing employment as well as managing inflation. In the speech on August 27th, Powell stated that while the Fed’s mandate has not materially changed, the Fed will be viewing that mandate through a longer lens. This means that they are willing to have higher inflation for some time to offset current lower interest rates. The Fed continues to want a long-term inflation rate of 2%, but it is willing to go above 2% in the short run if that means that the longer-term mean gets closer to 2%.

It appears that the Fed is indicating a willingness to allow the economy to heat up. It appears that they are doing so for the following reasons:

- The Federal Reserve notes that managing a deflationary environment (where prices are dropping), is much more difficult than an inflationary environment. A deflationary environment can be a vicious circle, where decreasing prices cause current demand to shrink due to expected lower prices. The drop in demand, in fact, causes the prices to drop further, thus creating this vicious cycle. While the Fed has developed tools to fight inflation, it does not have a robust set of policy tools to fight deflation. As such, the Fed will do what it can to ensure there is limited to no deflation.

- The Fed is looking at the economic and demographic disparity and has determined that it would like to do its part to help address that gap. Allowing the economy to overheat speeds up the recovery and helps some of the segments most hurt by the current pandemic, and therefore the focus is on both getting more people employed and improving the living conditions of those who are employed. This decision by the Fed may have been a measure to get ahead of proposed legislation that requires the Fed to specifically consider racial inequities in its policy decisions.

- The Fed is recognizing the lag in monetary policy and is broadening the time horizon, allowing it to plan for the long-term and thus be more consistent in behavior. Again, this is an attempt to avoid inadvertently causing a slowdown in the economy, when the economy is in the early stages of an expansion. The Fed believes that these changes are needed so that interest rates will naturally rise and give the Fed the ability to better manage future recessions. We believe that the Fed regrets raising rates back in 2018. It views itself as having moved too early and put the brakes on in the nascent stages of the 2008/2009 recovery. In this view, the Fed believes that prices are stable and inflation will likely be limited when the economy picks up speed.

Our opinion is that the Fed policy change is a good first step. The Fed is realizing that it needs to think longer-term and that by doing so, it can create a stronger monetary system. Gone are the days when the Fed was known for its opaqueness. The Fed followed up this message by stating that interest rates will not be raised until 2023.

Who does this help and who does this hurt?

Helps: (We’re assuming that interest rates are low, but positive and not deflationary.)

- Government – Low interest rates are a boon for government, as it lowers its borrowing cost. Money can be diverted for better use than payment of interest.

- Owners of assets – Low interest rates tend to be good for owners of assets. Generally lower interest rates increase home prices as well as asset prices.

- Lower income workers – Lower interest rates can be helpful for lower income workers. Lower interest rates tend to allow the economy to heat up and grow faster than normal. The rising tide tends to produce more jobs and raise incomes.

Hurts:

- Savers – Low interest rates can be harmful to savers, in that they may not be able to get the expected return, or they may seek riskier deals in search for yield. This could be individual savers, pensions, or government entities. Low interest rates could also force savers to pull other levers to meet cash flow needs, such as spending less or working longer, both options are naturally less desirable outcomes.

Our opinion is that the current Fed moves make sense, as to the current realities on the ground –wealth disparity, a drop in productivity, slowing economic growth, and the current employment situation.

While the focus here was on the Fed’s most recent announcements respective to interest rates, it is critical to understand that the Fed has also increased its balance sheet to unprecedented levels. The increase in the balance sheet has also allowed rates to decrease and been stimulative to both the economy and the stock market.

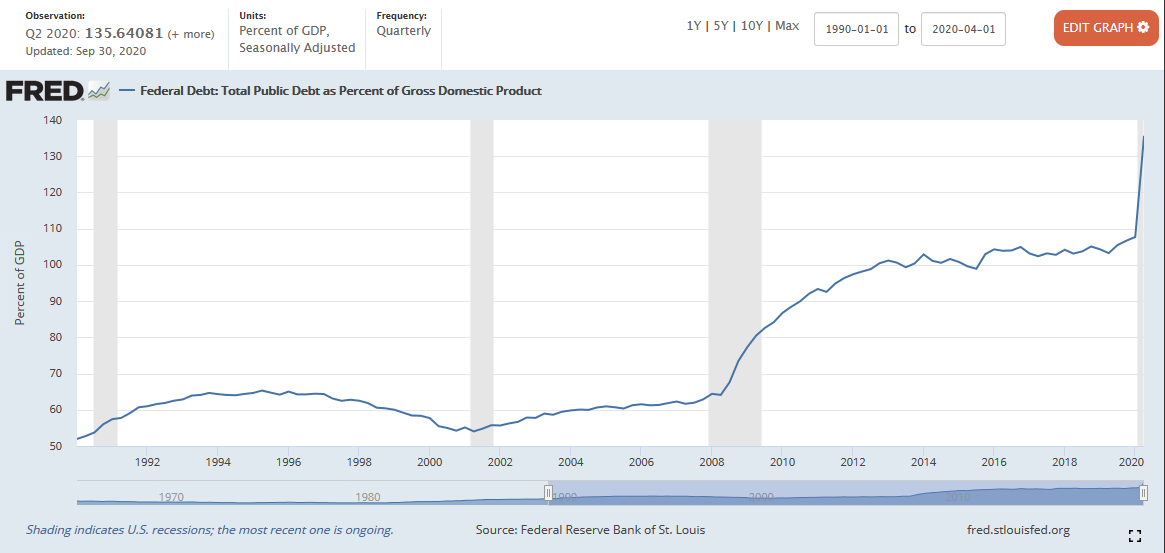

The size of the balance sheet and how the Fed moves forward is of great concern as at some point in time, the Fed is likely to unwind its balance sheet and in so doing will slow the economy. In addition, it is our belief that the total federal debt level has caused economic growth to be slower than normal over these last ten-plus years. We believe it is likely that Congress will authorize another massive stimulus package to assist those impacted by the pandemic. In the short run, the stimulus is likely to increase interest rates. However, we believe this will be short-lived. More debt will ultimately cause even slower economic growth in the future. Changing this dynamic will be extremely difficult and we don’t foresee a dramatic improvement in the growth rate until such times as debt levels decrease in relationship to GDP. As such, while there can be short-term increases in interest rates, we continue to believe that the long-term decline in interest rates is inevitable.

Source: https://fred.stlouisfed.org/series/GFDEGDQ188S#0