Rising Costs of Medicare — What to expect and what it means to you

Between the seemingly daily headlines announcing changes to Medicare and the alphabet soup of supplemental care insurance, we at Affiance Financial feel it is important for you to know what to expect with open-enrollment season upon us.

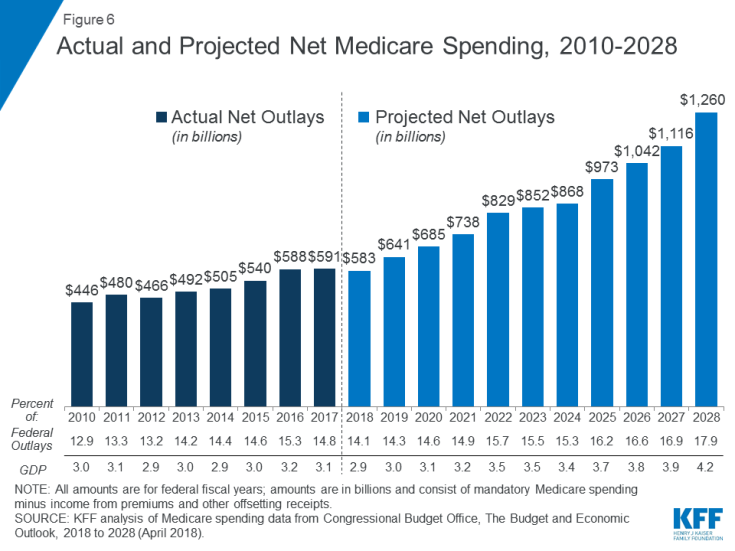

Currently, Medicare makes up almost 15% of federal spending, and that amount is increasing each year. It is estimated that by 2028, Medicare alone will be 4.2% of the nation’s GDP!

First — some basics. Anyone over the age of 65 is eligible for Medicare. You have from three months before to three months after the month you turn 65 to apply for Medicare. If you miss your enrollment period, you will pay a late penalty for life.* After applying for Medicare, you are enrolled in Part A (covers hospital stays) at no cost, and Part B (covers medical), for which you will be required to pay a monthly premium dependent on your Modified Adjusted Gross Income (MAGI). If you had income above $170,000 (married filing jointly), you could be required to pay more. Finally, you may choose to enroll in supplemental plans, the most common of which are Part D (drug coverage) and Medigap (additional coverage).

In 2018, not much changed for Part A, Part B, or the supplements. Things really start to change in 2019, namely with Part D. Starting next year, people enrolled in Medicare Part D will no longer be exposed to the “donut hole” — the coverage gap experienced when filling their brand-name prescriptions. As you can probably guess, this benefit has to be paid for, and will result in an increase in premium payments for Part B and/or Part D for those who earn $500,000 individually, and $750,000 married filing jointly. In addition, many Minnesotans will experience a change in 2019, as a federal law eliminates Medicare Cost plans across much of the state. It is estimated that about 320,000 people will lose their current plan and be forced to change plans this year.

At Affiance Financial, we keep abreast of current laws and do our best to incorporate updated medical costs in the financial plans we create for our clients before they enter into Medicare and retirement, or as we call it, financial independence. If you are working with an advisor and haven’t had this conversation yet, be sure to bring it up at your next meeting. It is important for us to help you prepare for the certainty of uncertainty, which can start with a conversation.

*There are two exceptions to this penalty: 1. If you are already receiving retirement benefits from Social Security or the Railroad Retirement Board, you will be enrolled in Medicare automatically and do not need to apply during your enrollment period. 2. You may delay Medicare enrollment if you are still enrolled in an accredited health insurance program through your or your spouse’s employer.

Sources:

https://www.kff.org/medicare/issue-brief/the-facts-on-medicare-spending-and-financing/

https://www.aarp.org/health/medicare-insurance/info-2018/medicare-changes-2019.html

http://m.startribune.com/index.php/minnesota-seniors-brace-for-seismic-medicare-shift/493430261/