Financial Planning Changes for 2020

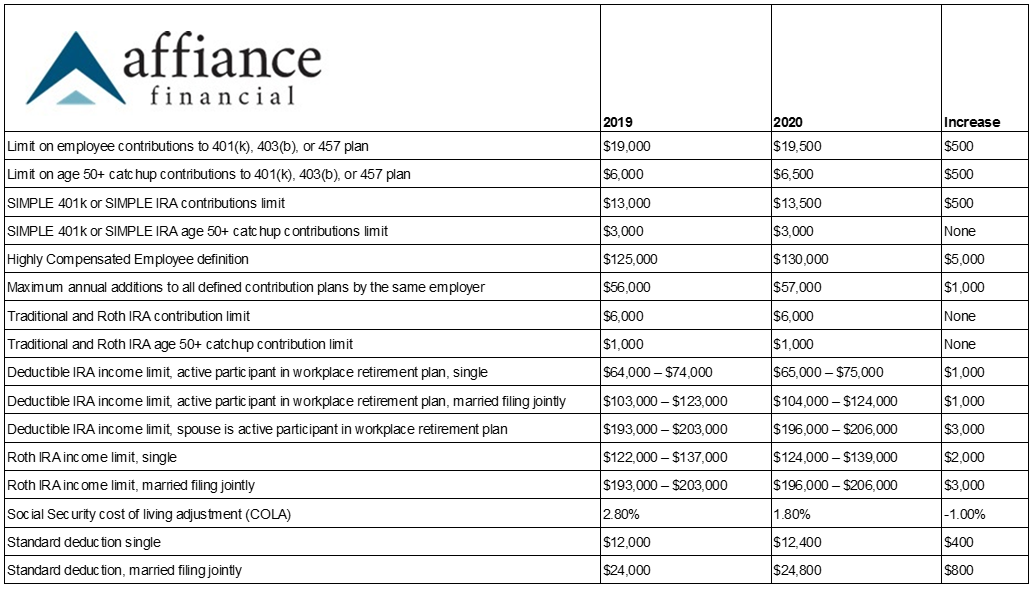

With 2019 in the rearview, we look forward to 2020. As you can imagine, with a new year comes changes to some key financial planning items. Below is a table showing some of the key adjustments for the 2020 tax year.

As you can see, there are some small changes to the various limits, which are pretty typical year over year. One change that you should take notice of, is that there is a $500 increase to the contribution limit for 401(k), 403(b), or 457 plans.

There are some additional Financial Planning changes for 2020 that the table above does not outline. These were part of the SECURE Act, which was signed into law late in 2019. One major change is the ability for individuals over age 70 ½ to contribute to a traditional IRA as long as they have earned income. In prior years, those individuals were not allowed to make deductible contributions. So, while IRA contribution limits for 2020 have not changed, the ability to make contributions as long as you are able to show earned income could prove to be helpful for some. More information on the SECURE Act can be found in this related blog post.

As we move into 2020, we will incorporate these changes into our financial planning work, and keep you updated of any other changes that come about. If you have specific questions regarding how these changes could affect your personal financial plan, please do not hesitate to reach out today.

The Financial Planning Changes for 2020 Blog Post is being provided for informational purposes only. Moreover, no client or prospective client should assume that this content serves as the receipt of, or a substitute for, personalized advice from Affiance Financial, or from any other professional. In addition, this content is not intended to provide specific tax advice. For specific tax advice, the services of an accountant should be sought.