Investing in an Election Year

One question we are asked every four years, without fail, is: How will the Presidential election affect the stock market? We anticipate that this year will be no different - as we move further into election season, investors will want to know if they are making the right choice by staying the course, or if this time really is different. Starting next week with Super Tuesday, and lasting until the final vote is cast, election headlines will be inescapable. Here are some of our key takeaways for investors to keep in mind as they weather the political storm this year.

How have Presidential elections historically affected stock market performance?

There is reason for some concern. Markets do not like uncertainty, and during an election year there is bound to be uncertainty. The 2024 Presidential election is likely to be even more turbulent than most. Never before have we had a candidate whose right to appear on the ballot was being actively challenged in court. Regardless of this year’s particular circumstances, stock markets have historically not responded well to the inherent uncertainty of an election year.

To illustrate this point, the graph above compares the average cumulative returns for the S&P 500 Index since 1932 during election years and non-election years. For the first part of the year, during primary season, markets tend to be flat or down. But in the second half of an election year, markets tend to return to stronger performance. Please remember that when it comes to investing, past performance is no guarantee of future results.

Does the winning political party affect stock market performance?

Many people are surprised to learn that historically, the winning political party has not had a significant effect on the stock market. Whether based on headline noise, recent results, or personal preference, it’s easy to be swept up in the belief that one political party has a distinct advantage over the other when it comes to your investments. But history shows us that simply isn’t the case. Given a long-enough time frame, the stock market doesn’t care whether a Democrat or Republican is in office. As you can see in the graph below, over time the S&P 500 marches on regardless of which party controls the White House.

How should I invest during an election year?

I know what you’re thinking – if we have all of this historical insight to guide us, why not get out of the market now, skip all the volatility, and then get back in after the primaries to capture the anticipated growth during the second half of the year? Because consistent market timing is impossible. Let’s pretend that you choose to move to cash now, the markets go down this month and it was the right move. That’s only half of the equation - you also have to choose the right time to get back in. It’s possible that you might make the right choice once, or even a handful of times. But making the right choice again and again over time is not possible. There is also the cost of taxes to consider, so the cost of trading can be much higher than just market returns.

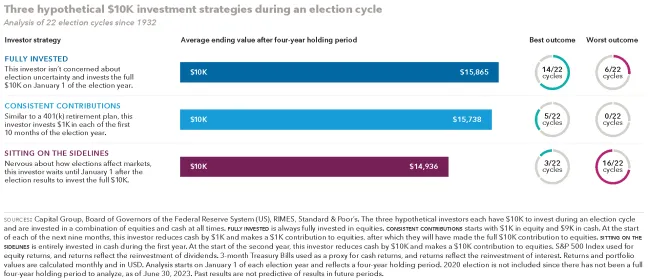

To illustrate this point, the table above shows three hypothetical $10,000 investments during the 22 election cycles since 1932. On average, investing before or consistently investing during an election will result in higher returns than sitting on the sidelines.

Historical market performance may be helpful for identifying trends and understanding causation. However, attempting to time the market is not a strategy for long-term success. Instead, work with your financial advisor to ensure you have a disciplined investment strategy that helps move you toward your long-term financial goals.

What other financial factors could be affected by the election results?

The winning candidate’s effect on (or lack thereof) the stock market is not the only financial factor that could be affected by a Presidential election. The Tax Cuts and Jobs Act (TCJA), passed in 2017, was the largest overhaul of the tax code in decades. Many provisions of the TCJA, including the marginal tax rates, are scheduled to sunset on December 31, 2025. So the results of the upcoming election will determine the future of the tax code.

Additionally, Jerome Powell’s term as chair of the Federal Reserve expires in 2026, and America’s next President will need to decide if he should serve a third term or if it is time for a new leader to take the reigns. The Fed plays a significant role in your investment strategy by setting the interest rates that drive bond prices.

Key Takeaways:

My key takeaways for an election year:

- Election results have little effect on long-term stock market returns.

- Stock market returns are usually more volatile for the first part of an election year, then tend to improve.

- Market timing doesn’t work over time. The key to successful investing is staying invested through all market conditions.

A Presidential election is a major event for all Americans. It’s natural to wonder how such an event - both the election itself as well as the outcome - might affect your future, especially the future of the hard-earned savings in your investment portfolio. But as with so many major humanitarian events, the stock market appears to care a lot less than we do.

If you have questions regarding your personal financial plan and how the 2024 Presidential election could affect your situation, please don’t hesitate to reach out to an Affiance Financial advisor. Having a conversation with a trusted financial planner is the best way to keep your financial plan on track, no matter what the political headline of the day might say.

Affiance Financial only conducts business in states where it is properly registered or is excluded from registration requirements. Registration as an investment adviser is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability.

All investment strategies have the potential for profit or loss. There are no assurances that a client’s portfolio will match or exceed any particular benchmark. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Different types of investments involve varying degrees of risk. Past performance and detailed processes do not guarantee future results. Please remember to contact Affiance Financial if there are any changes in your personal/financial situation or investment objectives.

Advisory services offered through Affiance Financial, a Registered Investment Adviser. Securities and advisory services offered by Registered Representatives and Investment Advisor Representatives through Private Client Services. Member FINRA, SIPC. Affiance Financial and Private Client Services are unaffiliated entities.

Charts and graphs do not represent the performance achieved by Affiance Financial or any of its advisory clients. The market’s hypothetical performance results do not reflect the impact that advisory fees and other expenses will have on an investor’s portfolio. Furthermore, investors’ liquidity needs, risk temperament, and financial goals may dramatically impact how their money is managed during election years. The likelihood of various investment outcomes is purely hypothetical. These possible outcomes do not represent actual investment results.

There is no guarantee that a specific investment or strategy will be suitable or profitable for an investor’s portfolio. Changes in investment strategies, contributions or withdrawals, and economic conditions, can materially change how your portfolio will perform. Historical performance returns for investment indexes and/or categories, usually do not deduct transaction and/or custodial charges or an advisory fee, which would decrease historical performance results.

Information presented is believed to be current. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the author on the date of publication and may change in the future.