Recency Bias During Uncertain Times

We hear it said all the time, seemingly everywhere, that we are living through unprecedented times. I can’t help but agree.

Six months ago, when March Madness was cancelled, I almost couldn’t believe it. How could something so big, so financially important, so culturally important (in my personal opinion), be cancelled? But we all know what came next, the cancelling of every major event, and most minor events, across the country. By May, when it was announced that the 2020 Minnesota State Fair was cancelled, I wasn’t a bit shocked. In just a few short months, my brain had been rewired to accept that crowds of that magnitude were an impossibility.

Reflecting on these unprecedented times, and how quickly they have changed not only our daily lives, but our minds, I felt like it was a good time to remind everyone about something called “recency bias.” Recency bias is the belief that something is more likely to happen because it occurred in the recent past. This bias is present in sports, gambling, weather, and everyday life. It is also very prevalent in the world of investing.

The volatility that the stock market has seen this year really has been unprecedented. In 2020, we’ve seen three of the top 20 largest daily drops by percentage in the S&P 500. We’ve also seen two of the top 20 largest daily gains by percentage. This all happened in a two-week period in March.

Not surprisingly, this two-week period was a busy one for me and my teammates at Affiance Financial. This was the first significant market correction of my career and I was able to experience first-hand several of the things I have learned about during my training. I found out just how difficult it was to get people to invest in the market during this time. Much of this can be explained through the lens of recency bias.

The market drop was so quick, so painful, and so fresh in people’s minds, that they no longer believed that the market was the best place to outpace inflation. This is when it’s important to remember that recent performance does not guarantee future results. After one of the worst months in the market’s history, we saw the best month in the S&P 500 since 1987.

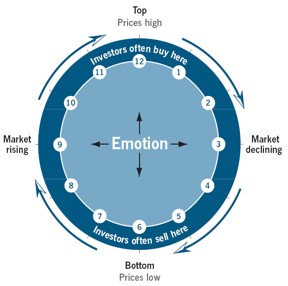

The graphic above shows recency bias in action. During a bull market, investors tend to forget about bear markets. They believe that the market will continue going up, since that’s what it has been doing recently. Emotions tell investors to buy when the market is up. The problem is that this is when stocks are most expensive.

The same is true for bear markets. In March, we saw a 33.92% drop in the S&P 500. During a drop like this, emotions tell investors not to buy, but this is what we try to avoid. We see this as an opportunity. Everybody likes a sale – except in the stock market. Recency bias overrides the market’s collective sense of rationality, because of how our brains are wired.

So, how did we help our clients deal with recency bias and get through one of the strangest periods of market activity in decades: By encouraging them to maintain a long-term investment plan. Our advice stayed consistent, “This is scary, but this happens, and the worst thing we can do is abandon our disciplined investment strategy.” We also went a step further and rebalanced portfolios, helping our clients buy stocks when they were down.

Please know that it is our fiduciary obligation to always act in your best interests. This includes looking for opportunities that we believe will benefit you in the long run, even when those opportunities seem scary. As the markets now reach new all-time highs, we are meeting regularly to evaluate the situation, and consider best next steps, which are often no steps at all. Do we know if we’ve seen the last of the Coronavirus recession? We simply cannot say, but we are here to answer your questions and help you through whatever is next.

Continue to stay connected to the people and hobbies that are important to you. And despite recency bias telling us otherwise, “This too will pass.”

There can be no assurance that the content made reference to directly or indirectly in this blog post will be suitable for your individual situation, or prove successful. Due to various factors, including changing conditions and/or applicable laws, the content is only reflective of current opinions or positions and is subject to change at any time and without notice. Moreover, you should not assume that any information contained in this blog post serves as the receipt of, or as a substitute for, personalized investment advice from Affiance Financial. Please remember to contact Affiance Financial if there are any changes in your personal/financial situation or investment objectives.