The Social Security Retirement Benefit – A Key Component of Retirement Planning

What is Social Security?

When helping our clients prepare for retirement, every situation looks a little different. Each client has unique spending needs and different income strategies to pay for those needs. But one component is the same – retirement planning always includes Social Security. For more than 85 years, Social Security has been paying retirement benefits to millions of Americans. Despite being a well-known and universal program, Social Security is complex. And even the most widely-known benefit, the retirement benefit, calls for careful consideration because of the significant impact it will have on your retirement.

When did SS Start?

Prior to Social Security, traditional financial resources stemmed from family, work, and charity. These resources remain important today, but for many they aren’t enough to support someone through retirement. Two main catalysts set the stage for the Social Security system: urbanization and economic change. With the industrial revolution came major population shifts from rural farms to cities. Prior to this urbanization, as family members aged, other family members stepped in to provide care. As people moved to cities, caring for older family members became less and less prevalent. Then, America faced the worst economic crisis in modern history - the Great Depression. In an attempt to curb the growing economic insecurity caused by these two major shifts, Franklin D. Roosevelt signed the Social Security Act into law on August 14, 1935. While the benefits and size of the program have changed, the idea remains the same: Promote the economic security of the nation’s people.

Why is it important?

There are six major categories of benefits administered by the Social Security Administration including retirement, disability, family, survivors’, Medicare, and Supplemental Security Income (SSI). But, the most widely known benefit is the retirement benefit. The retirement benefits can often bridge the gap between needing to work longer to reach your retirement savings goals and becoming financially independent. According to the Social Security Administration (SSA), for half of all individuals aged 65 or older, Social Security accounts for 50% of household income; and for every one out of five people aged 65 or older, Social Security accounts for a staggering 90% of household income. While Social Security is intended to supplement income in retirement, the program is heavily relied on by many retirees to replace income in retirement.

How do I become eligible?

To qualify for retirement benefits, a worker must be fully insured. This means that a worker must earn a certain number of credits, or quarters, under the Social Security system. Four credits, or four quarters of coverage, can be earned each year. In 2022, the amount of earnings required to receive one credit is $1,510. However, quarters of coverage are determined based on annual earnings, regardless of when the income is earned during the year. Thus, someone who earns at least $6,040 in 2022 will be credited for all four quarters. After obtaining 40 credits, a worker is considered fully insured and eligible to receive benefits under the Social Security system.

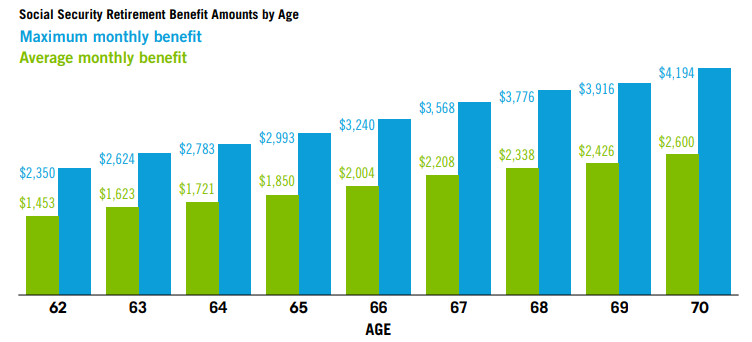

Once the eligibility requirements are met, a worker can begin taking their retirement benefit as early as age 62 or as late as age 70. Your Full Retirement Age (FRA), is the age at which you will receive the full benefit amount, also known as your Primary Insurance Amount (PIA). Your FRA will vary between ages 65 and 67, depending on the year in which you were born. If you decide to begin taking your benefit prior to your FRA, you will receive a reduced benefit amount. The earlier you begin taking Social Security, the larger the reduction to your benefit. The opposite is also true – if you delay your benefit after you’ve reached your FRA, you will receive an increased benefit amount. For each year you wait, you receive an 8% increase plus a Cost-of-Living Adjustment (COLA) until you reach age 70.

(Estimated Social Security benefits at different ages for claims filed in 2022. Maximum monthly benefit assumes 35 years of income exceeding the Social Security payroll tax cap, which in 2022 is $147,000. Average monthly benefit assumes 35 years of income matching the national average wage index series, which in 2020, the most recent year available, was $55,628.60.)

But, that doesn’t mean everyone should wait as long as possible to take Social Security. There are many reasons it might make sense for someone to take Social Security right at their FRA, or even before. Seek the council of your Affiance advisor before deciding what is right for you.

Will SS Run Out?

One of the biggest concerns regarding Social Security is whether it will provide retirees with benefits in the years to come. With so many Americans relying on Social Security to provide them with the income they need, the thought of the program becoming insolvent can be daunting. It’s true, the system is facing significant financing shortfalls. Two of the primary issues that need to be considered are a rapidly aging U.S. population and a significant increase in life expectancies.

Each year, the Social Security Board of Trustees reports on the current and projected financial status of the program. According to the June 2022 report, the trust fund which pays retirement and survivors benefits will be able to make scheduled benefit payments on a timely basis until 2034. At that time, the funds will be depleted and continuing tax revenue will only be sufficient to pay 77% of scheduled benefits. There is no doubt that the program has significant issues to overcome. However, lawmakers have many policy options to reduce or eliminate these shortfalls. The likelihood of the program becoming a thing of the past is close to zero. Social Security may look different in the future, but you can expect to receive your benefit in retirement.

Navigating Social Security is a complicated, but critical part of the retirement planning process. If you have questions about how your Social Security benefit fits into your financial plan, please reach out to your Affiance Financial advisor.

Sources: SSA.gov, “Insurance Planning” 7th edition, James F. Dalton et al., https://www.franklintempleton.com/forms-literature/download/HS-WBOOK

There can be no assurance that the content made reference to directly or indirectly in this blog post will be suitable for your individual situation, or prove successful. Due to various factors, including changing conditions and/or applicable laws, the content is only reflective of current opinions or positions and is subject to change at any time and without notice. Moreover, you should not assume that any information contained in this blog post serves as the receipt of, or as a substitute for, personalized investment advice from Affiance Financial. Please remember to contact Affiance Financial if there are any changes in your personal/financial situation or investment objectives.