Virtual Currency Activity? The IRS Wants to Know About it.

Steven E. Warren, CPA, MBT practices accounting and consulting at SDK CPAs, a Minneapolis CPA and consulting firm. Mr. Warren can be contacted at swarren@sdkcpa.com or 612-332-9391.

Virtual currency: Is it an investment? Is it currency? Is it a side hustle? For a growing number of us, the answer matters. Included in “us” is the IRS, which no surprise, wants a piece of the action.

The Question

“At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?” This question originally appeared as the first question on 2019’s Form 1040 Schedule 1, a schedule not everyone uses. The same question updated for 2020 appears on 2020’s Form 1040 page 1 just below your name and address. The prominent placement is a strong clue regarding the IRS’s intent on taxing reportable transactions when applicable.

On December 18, 2020, the United States Treasury Department released a proposal to require exchanges to report virtual currency transactions above $10,000 in value like banks are currently required to do with currency transactions. The IRS has already sent letters to select taxpayers it believes have had reportable virtual currency transactions that so far have eluded tax returns.

How is Virtual Currency Taxed?

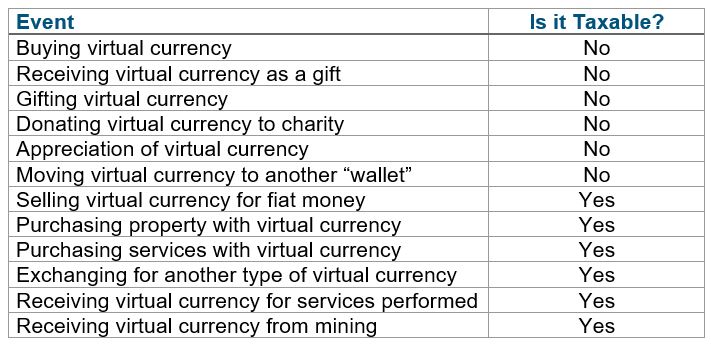

Some countries treat virtual currency like traditional currency (also known as fiat money) for tax purposes. In fact, some countries issue their own virtual currencies. In the U.S. we treat virtual currency like property for tax purposes. That means when you sell it, regardless of what you sell it for, you must report the gain or loss on your tax return.

There is no tax owed merely on the purchase of virtual currency or its appreciation in value without its disposition. Its basis is the purchase price of the virtual currency, including commissions and fees plus any reinvested interest income. Any interest earned on virtual currency is taxable in the year earned whether reinvested or not.

Example: Johnny buys 1 Bitcoin for $15,000 on November 7, 2020. Johnny purchased the equipment and materials he needs to remodel his bathroom from Home Depot on November 25, 2020, for half of a Bitcoin. The selling price of Johnny’s purchase was $8,500; therefore, Johnny has a short-term capital gain of $1,000 [$8,500 value of items received - $7,500 basis of Johnny’s ½ Bitcoin spent] to report on his tax return.

RECEIVING VIRTUAL CURRENCY FOR SERVICES PERFORMED

When virtual currency is received for services performed as an employee, the value of the virtual currency on the date of receipt is includible as taxable wages to the employee, and subject to income tax and payroll tax withholding. When virtual currency is received for services performed by an independent contractor, the value of the virtual currency received is ordinary income subject to self-employment tax. In both instances the valuation in U.S. dollars is normally as of when the virtual currency was received.

MINING FOR VIRTUAL CURRENCY

Mining is a way to earn virtual currency. The value of the virtual currency earned on the date received is taxable. It’s reported on Form 1040 Schedule C when you are an unincorporated sole owner of the business and are considered in the trade or business of mining for tax purposes. Related expenses are deductible on the same form and the net income is subject to self-employment tax. When not considered in the trade or business of mining, the income receives ordinary treatment, is not subject to self-employment tax, and the related expenses normally are not deductible.

Tracking Your Activity

Tracking your virtual currency activity is critical to make sure you are properly reporting your activity. While marketable securities transactions are normally tracked and reported to you by your broker or mutual fund company on a Form 1099-B or equivalent statement that includes reportable basis, most virtual currency exchanges do not provide those forms. Exchanges that do provide Form 1099-Bs typically do not provide basis information.

You will receive a Form 1099-K from an exchange when you have over $20,000 in payments and over 200 transactions in a year. Form 1099-K lets the IRS know you likely had reportable activity but it does not give you the information you need for your tax return.

There are numerous private companies selling tracking software that can be used for entering your transactions. The better software produces easy to read reports for use when preparing your income tax returns. Depending on your activity type and level, use of software can take what might be a challenging and great administrative burden down to a moderate administrative burden. Someone still has to enter the proper information, which could take many hours depending on the amount and type of activities involved.

Parting Takes

Be aware that if you have had virtual currency transactions or are considering partaking, the IRS is on the hunt for unreported activity. Properly tracking your virtual currency activity can be an administrative burden, but is important to do. This article is intended only to be an introduction to the taxation of virtual currency. There can be other virtual currency events not covered in this article that are reportable and in some cases taxable.

This article is being provided for informational purposes only. It is not intended to provide specific tax advice. For specific tax advice, the services of an accountant should be sought. Affiance Financial does not serve as an accountant and does not prepare tax returns. All information is believed to be from reliable sources. However, we make no representation as to its completeness or accuracy.