Your Guide to Required Minimum Distributions (RMDs): What You Need to Know

By Lucas Warner, FPQP® and Chris Johnson, CFP®

What’s Included:

- What Are Required Minimum Distributions (RMDs)?

- When Do RMDs Start?

- How Are RMDs Calculated?

- Which Accounts Are Subject to RMDs?

- How Can You Take Your RMD?

- What Are the Tax Implications of RMDs?

- What Are Smart RMD Strategies to Consider?

- What Are the RMD Rules for Inherited Accounts?

- Final Thoughts

Required Minimum Distributions (RMDs) are withdrawals that the Internal Revenue Service (IRS) mandates from certain retirement accounts once an individual reaches a specified age. These withdrawals ensure that funds contributed on a pre-tax or tax-deductible basis, and which have grown tax-deferred over the years, are ultimately subject to ordinary income tax.

For retirees, those nearing retirement, and beneficiaries of retirement accounts, understanding RMDs is essential to avoiding IRS penalties, managing tax obligations effectively, and aligning withdrawals with personal financial goals.

This guide outlines the key rules governing RMDs, how to calculate and take them, the associated tax implications, and the requirements for inherited accounts.

What Are Required Minimum Distributions?

An RMD represents the minimum amount that must be withdrawn annually from tax-deferred retirement accounts once the account holder reaches a specific age, which varies depending on their birthdate. The IRS establishes these rules so that taxes on deferred income are ultimately paid, preventing individuals from deferring taxes indefinitely.

When do RMDs start?

As of 2025, the RMD rules stipulate:

- Individuals born between 1951 and 1959 must begin taking RMDs in the year they turn age 73.

- Individuals born in 1960 or later must begin taking RMDs in the year they turn age 75.

- Individuals can delay their first RMD until April 1 of the year following the year they reach their RMD age. If delayed, they must take both their first and second RMDs in the same year, which may result in additional taxable income.

At Affiance Financial, our Financial Planners encourage their clients to satisfy their RMD by the end of the calendar year to avoid double counting and extra distributions the following year.

How Are RMDs Calculated?

The required distribution amount is calculated by dividing the total balance of all applicable retirement accounts as of December 31 of the prior year by a life expectancy factor provided by the IRS.

RMD = Total account balance(s) as of December 31 (previous year) ÷ IRS life expectancy divisor

For example, if your IRA balance(s) at the end of the previous year totaled $300,000, and your IRS life expectancy divisor is 24.6, your RMD would total $12,195.12 and must be withdrawn by the end of the current calendar year (or April 1 of the following year if it’s your first-year RMD).

$12,195.12 = $300,000 ÷ 24.6

As you age, the IRS life expectancy divisor used to calculate RMDs decreases. This results in a higher withdrawal percentage relative to your account balance each year, which typically leads to larger required distributions over time. The RMD represents the minimum amount that must be withdrawn annually. While there are no penalties for withdrawing more than the required amount, it's important to consider the potential tax implications of larger distributions.

The year-end value used to calculate RMDs is the combined total of all Individual Retirement Account (IRA) balances as of December 31 of the previous year. If you own multiple IRAs and have reached RMD age, you can satisfy your total RMD by withdrawing the full amount from just one account, rather than proportionally from each.

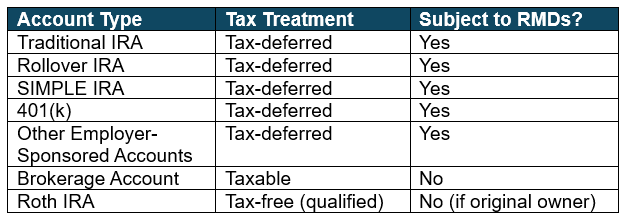

Please note that the RMD aggregation rule (described above) applies only to Traditional IRAs, Rollover IRAs, SEP IRAs, and SIMPLE IRAs. Employer-sponsored retirement plans, such as 401(k), 403(b), or certain deferred compensation plans, are each subject to different RMD rules. It’s important to understand the specific requirements for each type of account.

Individuals who are still employed and have an employer-sponsored retirement account (401(k), 403(b), or certain deferred compensation plans), can generally postpone their RMDs until the year they retire unless they own more than 5% of the business sponsoring the plan. However, other accounts, such as IRAs, remain subject to RMDs regardless of employment status.

Failure to take the required distribution on time can result in a significant penalty, up to 25% of the amount not withdrawn. However, if the mistake is corrected within two years, the penalty may be reduced to 10%. This penalty is in addition to the RMD itself, meaning the missed distribution amount must still be withdrawn and is subject to income tax.

Which Accounts Are Subject to RMDs?

Inherited IRAs are also subject to RMDs, but they have different rules, which are discussed below.

How Can You Take Your RMD?

You may satisfy your RMD in various ways, depending on your financial situation and objectives:

Withdraw the RMD and deposit to your bank account

This is the most straightforward method. Many retirees use RMDs as a source of income, transferring the funds directly into checking or savings accounts. You may choose to withdraw the full RMD at once as a lump sum or spread it out during the year (monthly, quarterly, etc.).

Transfer to a taxable account and reinvest

If you do not require the funds for supplemental income, you may transfer your RMD to a taxable brokerage account and reinvest it. Although the withdrawal is still considered taxable income, reinvesting allows your funds to continue growing outside of tax-deferred accounts.

Make qualified charitable distributions (QCDs)

Individuals aged 70½ or older may donate up to $108,000 annually (2025 limit) directly from their IRA to a qualified 501(c)(3) charity. QCDs count toward your RMD and are excluded from taxable income, providing tax advantages.

Please note, Affiance Financial can assist you with making QCDs. Please reach out to your advisor to get started.

Combine multiple options

You may fulfill your total RMD through a combination of these methods, such as withdrawing part as income, donating part to charity, and reinvesting the rest. Your strategy should be tailored to your lifestyle, charitable goals, and financial plan.

What Are the Tax Implications of RMDs?

RMDs are taxed as ordinary income in the year they are withdrawn. They increase your adjusted gross income (AGI), which may push you into a higher tax bracket.

Because RMDs can affect your tax liability, including eligibility for tax credits, deductions, and Medicare premiums, it is important to plan your distributions carefully. Consulting with your financial planner can help ensure your RMDs are managed efficiently and that you are receiving the proper tax treatment when preparing your return.

What Are Smart RMD Strategies to Consider?

Several strategies can help minimize the tax impact of RMDs and help optimize retirement income:

QCD Strategy

- Donate directly from your IRA to a qualified charity to satisfy your RMD. The donated amount is excluded from taxable income, potentially lowering your overall tax liability.

Roth Conversions

- Completing Roth conversions prior to turning RMD age can reduce the value of your tax-deferred assets that are subject to RMDs in the future. This results in lower RMDs and potentially lower taxes in retirement.

Account Specific Distributions

- If you have more than one tax-deferred account, it may be advantageous to take your RMD from one account over another. For example, you might take your RMD from an account with lower growth potential, allowing you to preserve assets in other accounts and take advantage of compounding interest.

Your financial planner can help you design a customized RMD strategy to fit your unique circumstances.

What Are the RMD Rules for Inherited Accounts?

If you inherit a retirement account, the RMD requirements depend on your relationship to the original owner and the date of the owner’s death.

Non-Spouse Beneficiaries

- For accounts inherited after January 1, 2020: most non-spouse beneficiaries must withdraw all funds within 10 years. This means the account must be fully depleted by the end of the tenth year following the year of the original owner's death.

- If the original owner had begun taking RMDs, annual distributions may be applicable for your specific case.

Spouse Beneficiaries

- Spouses have more flexibility. They may:

- Treat the inherited account as their own, delaying distributions until their own RMD age.

- Take distributions based on their life expectancy.

- Withdraw the entire amount, which will all count as ordinary income.

Other Eligible Beneficiaries

- Certain beneficiaries, such as minor children, disabled individuals, and chronically ill persons, may stretch distributions over their lifetime.

Final Thoughts

Required minimum distributions are an important element of retirement planning. Proper understanding and management of RMDs can help retirees and beneficiaries avoid costly penalties and excessive taxes while aligning distributions with personal financial goals.

If you are nearing RMD age or have inherited a retirement account, it is advisable to consult with a financial planner to develop an appropriate strategy tailored to your needs.

For assistance with calculating your RMD, planning withdrawals, or coordinating charitable giving through QCDs, please contact Affiance Financial today.

The views represented are not meant to be construed as advice. Moreover, no client or prospective client should assume that this content serves as the receipt of, or a substitute for, personalized advice from Affiance Financial, or from any other professional.

Affiance Financial is registered as an investment adviser and only conducts business in states where it is properly registered or is excluded from registration requirements. Registration as an investment adviser is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability. The firm is not engaged in the practice of law or accounting.

Content should not be viewed as legal or tax advice. You should always consult an attorney or tax professional regarding your specific legal or tax situation. 401(k), IRA, and tax rules are subject to change at any time.

Affiance Financial does not serve as an accountant and does not prepare tax returns.

All investment strategies have the potential for profit or loss. Insurance product guarantees are subject to the claims-paying ability of the issuing company and are not FDIC insured.

Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy. It is general in nature and should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Tax and legal rules and regulations are subject to change at any time.