Fall 2022 Market Commentary

By Marc Usem and the Affiance Financial Investment Committee

Inflation’s Bitter Pill

September was the worst single month for the S&P 500 since March of 2020, and, combined with the first three quarters of the year, it contributed to the worst nine-month stretch since 2002. For the first quarter, the index was down -4.9%. Bonds nearly matched stocks, being down -4.7%. International stocks were down -10.4% and emerging markets fell by -13%. Even gold was down -8%. Only cash has been a safe haven, but remains subject to inflation exceeding 8%. It was a bad quarter for portfolios and there has been nowhere to hide. The same is true for the year-to-date returns – we ended the quarter in a bear market for stocks, down -20%, and bonds down nearly -15%, in the worst year for combined stock and bond losses since the 1980s. The culprit in this situation is largely attributed to inflation and the Fed.

Inflation is the headline issue of 2022, but how did we get here? The Covid-19 pandemic ushered in a period of unprecedented disruption to the economy including labor markets, supply chains, and massive global government stimulus. The goal was for governments to plug the hole caused by lockdowns and economic turmoil. As the economy reopened and easy money flowed, inflation ensued, with price expansion across assets including financial, business, and real estate. Fragile supply chain issues were highlighted by shipping and logistics problems as well as industry-specific issues such as computer chip shortages, which continue today. China’s zero-Covid policy has significantly impacted millions of people, further disrupting industry and shipping. Tight U.S. labor markets have led to a welcome increase in wage inflation that had been stagnant for decades, but also stokes inflationary pressures. Russia’s war in Ukraine further fueled the inflation fire as food and energy became weapons of war and resulted in soaring grain, gas, and oil prices as well as humanitarian adversity. Supply side and demand side factors have both led to today’s inflationary pressures, which have reached 40-year highs both here and in Europe.

How do we reduce inflation? The Federal Reserve has a dual mandate of full employment and price stability – i.e. it’s their job. With unemployment still near record lows, inflation is their only focus. They have clearly stated they will “do whatever it takes” to fight inflation with higher rates and they have been good to their word. However, their main tools to fight inflation only influence the demand side of the equation – raising interest rates to slow the economy and aggregate demand for money (and goods). Supply-side issues are left to industry and the government to resolve. Raising interest rates at the fastest pace in history, the Fed Funds rate has gone from 0.25% in January to 3.25% today. Higher rates impact all industries that borrow money, which is most, but it generally takes six to twelve months to take effect. We are seeing the impact now, as some of the most interest-rate sensitive industries, such as real estate, have softened as mortgage rates have more than doubled this year.

What about the stock and bond markets? Rising interest rates tend to be bad for stocks and bonds. Bond prices move in the opposite direction of interest rates and 2022 has been the worst market for bonds since the inflationary period during the 1980s. Stocks have also slid into bear-market territory this year, as higher rates reduce the present value of future cash flows resulting in lower price/earnings ratios. Fears of recession also weigh on expected earnings from companies resulting in lower prices. Bonds held up in the bear markets in 2000, 2008 and 2020, softening the blow to balanced portfolios. That has not been the case this year. The good news is that bonds, once again, yield more than 0%, so investors can start to earn some interest by lending money to companies.

What’s next? Our economy is stronger today than parallels of the 1970s and 1980s, with a strong U.S. dollar, energy independence, stronger corporate balance sheets, and more nimble service-focused industries mitigating some of the impacts of earlier inflation cycles. Whether we are in a recession now or we will be in a recession soon is debatable, but what matters most is how we handle the situation. Our portfolios have been adjusted during the year to try to reduce the impact of higher rates on bonds by using market-neutral hedged strategies, utilizing a defined outcome hedge fund for rebalancing, embracing more value-oriented stocks than growth, and focusing more on U.S. than overseas. While our changes have helped on the margin, we are still subject to market forces. We have emphasized how critical it is to keep cash needed for current use, and this year is a perfect example for why we make this recommendation.

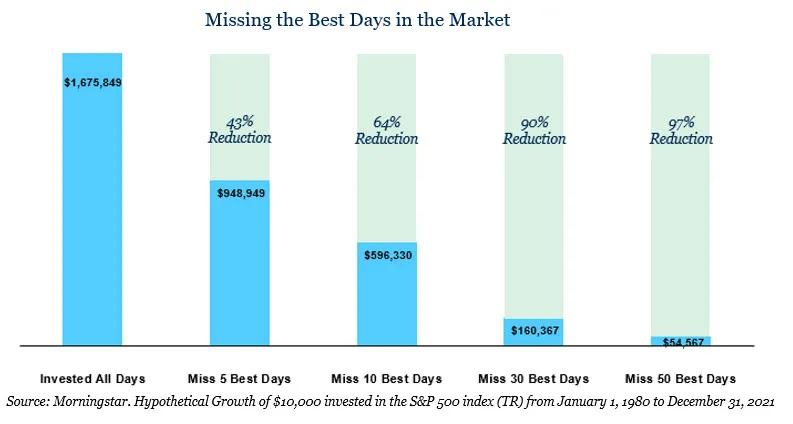

Stocks may fall further if valuations reach prior bear market lows and the Fed continues to raise rates. At the same time, rebound rallies can be rapid, and we have seen volatility rising in recent weeks. Volatility can cause investors’ concern, but history has shown that staying the course results in favorable outcomes. We are not market timers, and will not risk missing the best days when markets are swinging wildly.

There are many risks we can’t control: a major investment bank default (Credit Suisse), a government policy mistake in Britain (close call), OPEC supply cuts, soaring U.S. dollar, or the results of upcoming mid-term elections. We will remain disciplined to focus on those things we can control including opportunities that may arise in stock and bond markets, portfolio rebalancing, cash management, and tax planning. Please reach out to your advisor with specific questions or concerns.

Thank you for your continued confidence in our work.

Sources: stlouisfed.org, wsj.com, ycharts.com, Morningstar

The views represented in this commentary are not meant to be construed as advice, testimonial or condemnation of any specific sector or holding. Investors cannot invest directly in an index. Unmanaged indexes do not reflect management fees and transaction costs that are associated with some investments. Past performance is no guarantee of future results. To discuss any matters in more detail, please contact your financial advisor.