Financial Planning Changes for 2019

At Affiance Financial, it is one of our core values to stay curious. Part of that includes staying up to date on the current — and always changing — laws that affect financial planning.

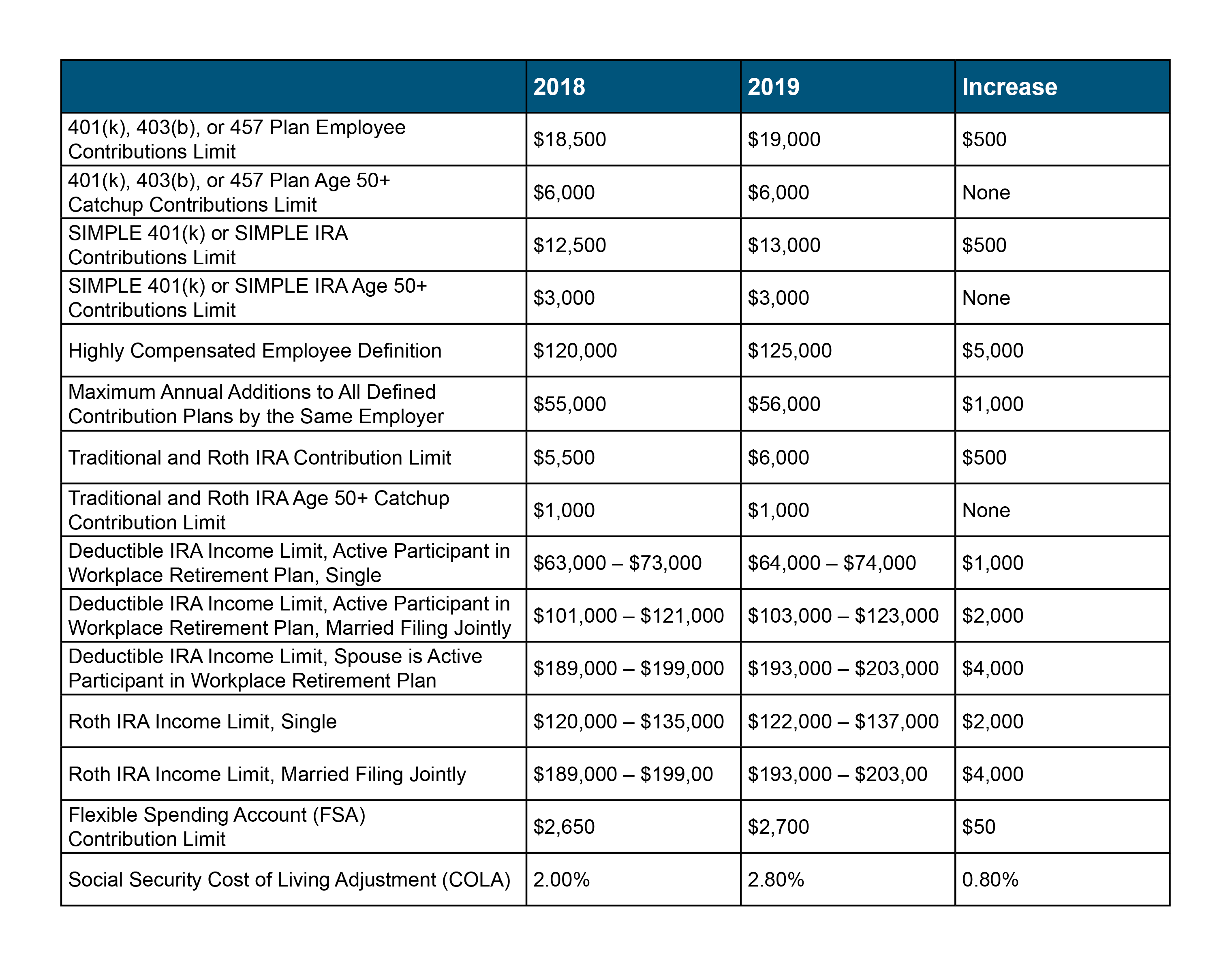

For 2019, there are a number of subtle changes to the cost of living adjustment (COLA) for Social Security and the contributions limits for 401(k), 403(b), 457, and IRA accounts that are important to take into consideration when reviewing your financial plan. While I could drone on about what the changes are, I feel it is more effective to lay it out in a nice clean table:

To summarize, there has been an increase to the contribution limits on retirement accounts by $500, making them nice round numbers, while the $6,000 qualified plan and $1,000 IRA catch up contributions for those age 50 and older remain unchanged. Also, as expected, the income limits for IRA and Roth IRA contributions have both increased with inflation. In addition, for 2019 there will be a cost of living adjustment (COLA) of 2.8% to all Social Security benefits, which is 0.8% higher than the 2% increase in 2018.

These changes are welcome for savers and provide an opportunity to increase contributions into tax-deferred or tax-free accounts. As we stay curious, we will continue to incorporate these changes into your financial plans and keep you updated the best we can as we move into 2019. But, if you have specific questions regarding how these changes could affect your personal financial plan, please do not hesitate to reach out today.

Sources: