Pay Yourself First

As a firm, we are blessed with the clients we have. A number of them go out of their way to help support those they love. This often means helping their parents as they age, but it also includes helping their adult children. While we admire our clients’ desires to help those around them, this could pose a serious issue, maybe not immediately, but rather much further down the road.

We have a phrase that we use in meetings with our clients — Pay Yourself First. On the surface, this comes off as a selfish statement, but that is not our intention. We use this statement simply because we sometimes are our own worst enemies.

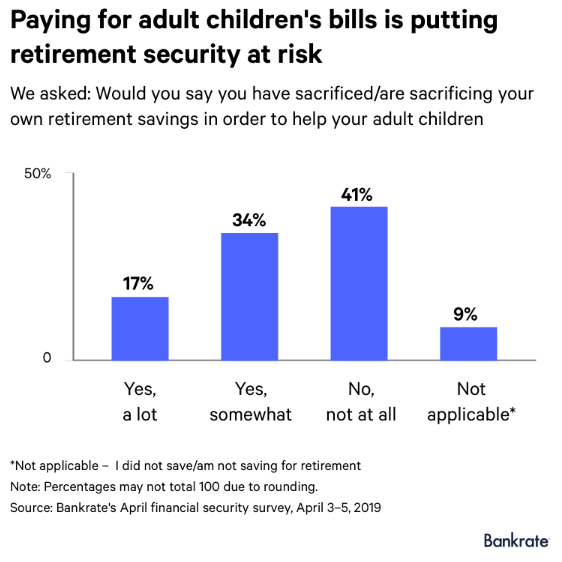

A survey by Bankrate states that more than half of all working Americans are sacrificing their own financial independence in order to help their adult children. A number of circumstances that were not an issue for previous generations have contributed to this. These include the Great Recession, the student debt problem, and low wage growth, to name a few. These circumstances have caused a number of younger people to rely on some sort of support from family members. In some cases, this comes in the form of paying rent or bills or moving back into their parent’s home.

Most often, we see this with parents going above and beyond to pay for their children’s education, whether it be undergraduate or graduate school, out of fear of their children being included in the student debt statistic. It is a blessing to the student that their parents are willing to make such a large contribution to their future, and some parents are able to handle the extra financial burden. But a lot of times, it comes at the expense of the parents’ own retirement picture.

While we certainly understand the reason parents do this, the fact of the matter is, you cannot borrow money for your retirement. You can borrow money for a home, a car, an appliance, or even an education, but you cannot borrow for your retirement. That is why it is crucial to Pay Yourself First. If you are providing more for someone else, such as an adult child, than you are providing for yourself, you may not reach the financial independence you are striving for. According to the same Bankrate survey, some retirees are even returning to the workforce, albeit not necessarily full-time, in order to help their adult children.

We understand that everyone’s financial situation and financial plan is unique. Finding balance between the desire to help your loved ones and the need to secure your own future can be a major challenge. That’s why it is important to seek out guidance when trying to work through some of the difficult decisions life hands out, especially if your own financial independence may be affected.

Reach out to your Affiance Financial Advisor to discuss your personal situation today.

Sources:

- https://www.bankrate.com/personal-finance/financial-independence-survey-april-2019/

- https://www.cbsnews.com/news/adult-children-are-costing-many-parents-their-retirements/

Please remember there can be no assurance that the content made reference to directly or indirectly in this article will be profitable, or suitable for your individual situation, or prove successful. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized advice from Affiance Financial. Please remember to contact Affiance Financial if there are any changes in your personal/financial situation or investment objectives.